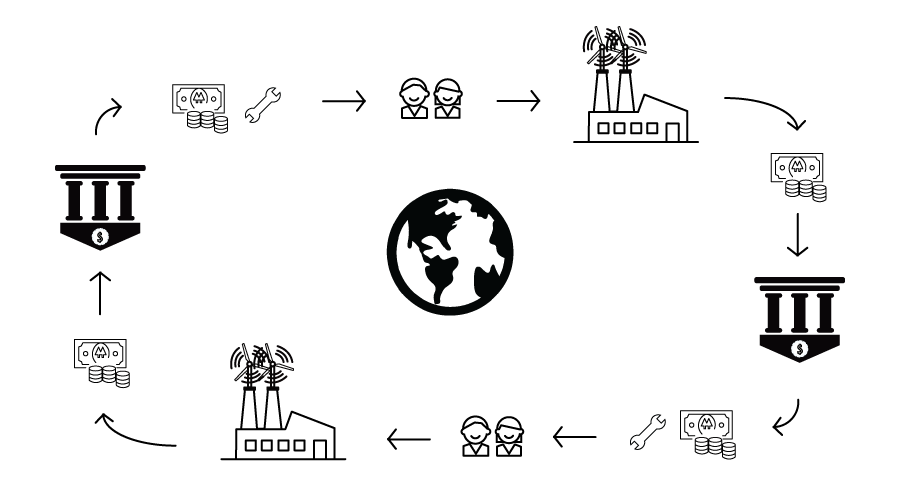

Non-extractive funding

Returns to the lender never exceed the wealth created by the borrower.

What are some key problems that this process can solve?

This process attempts to make life easier for small businesses or cooperatives, while also enabling the community to support businesses that are good for the community.

How does this process work?

To enable more cooperative-minded, small businesses to exist, some funding cooperatives operate by non-extractive principles. While its implementation may change form, typically, non-extractive funding does not require the borrower to make interest or principal repayments until they are able to cover operating costs. "Imagine if 'debt' was no longer something that those who don't have owe to those who have, but rather if 'debt' was something owed to the commons by those who have surplus so that it can be borrowed by those who are in need..." (Cooperation Buffalo's "What the H*ck is Non-Extractive Finance? Webinar")

|

№ OF PEOPLE |

inform | Consult | Involve | Collaborate | Empower |

|---|---|---|---|---|---|

1—100 pPL |

|||||

100—1k pPL |

|||||

1k—10k pPL |

Seed Commons’ non-extractive community wealth management for cooperative businesses | ||||

10k—100k pPL |

|||||

100k—1M pPL |

|||||

1M—10M pPL |

|||||

10M—100M pPL |

|||||

100M—1B pPL |

|||||

1B+ pPL |

|||||

Global |